People on £10,000 to £96,000 tell us what they want from the Spending Review

Lewis Eager

Lewis EagerThis week the government will set out how much it is going to spend over the next four years on the public services that millions of people use every day.

That includes the NHS, schools and public transport as well as welfare benefits, armed forces, energy projects and a whole range of other government spending.

We asked a handful of readers, who had contacted the BBC via Your Voice, Your BBC News, what they would like to see in Wednesday's announcement.

'I earn £850 a month. Young people need better jobs'

Lewis Eager / BBC

Lewis Eager / BBCLewis Eager, 26, works two shifts a week in the on-demand delivery service for a supermarket in Southend-on-Sea, earning £850 a month. He lives with his parents who he pays £120 a month.

He would like the Spending Review to include a plan to help young people like him find well-paid, full-time jobs.

Lewis completed a business administration apprenticeship and an Open University degree, but says he cannot find full-time work.

He estimates he has applied for more than 4,000 jobs without success.

"Getting knocked down all the time is horrible."

Even entry-level jobs seem to require experience, he says.

He sees a "looming crisis" among young people unable to get on the jobs ladder, and would like to see more money go into adult education.

"I live with my parents which I have nothing against, but I thought I would have achieved more by now," he says.

'We earn £52,500. We need more help with childcare'

Resheka Senior / BBC

Resheka Senior / BBCResheka Senior, 39, is a nursery nurse and her husband Marcus, 49, a school caretaker. Between them they take home more than £50,000 a year. But the couple say they are still struggling, particularly while Resheka is on maternity leave.

When she goes back to work, Resheka says she won't be much better off because she will have to pay for childcare before and after school for her five-year-old and all day for the younger children, aged two and nine-months.

They have debts that they are shuffling between credit cards and no prospect of moving out of their two-bedroom council flat in Woolwich, London.

"I don't want to stay at home. I've been working since I was 15 years old," says Resheka. But she would like to see more support for couples who are "making an honest living".

She wants the government to pay for free breakfast and afterschool clubs or more free childcare on top of the 30 hours a week currently provided.

"It's not as if I'm saying I want benefits," she says. "We're putting back into the economy. We just need some help."

'We earn £71,000. The UK needs more apprenticeships'

Grace Sangster / BBC

Grace Sangster / BBCOllie Vass works for a nutritional supplement company, where he earns £31,000. His girlfriend Grace Sangster also 19 is on an apprenticeship scheme earning £40,000.

They each started saving from the age of 13, earning money mowing lawns and working in restaurants.

In April, with the help of a small inheritance and their Lifetime ISAs, the couple completed on a £360,000 two-bedroomed terraced house near Slough.

Ollie and Grace would like to see more support for young people starting out, especially first-time buyers, and more apprenticeships.

They also think the tax-free allowance, which has been frozen since 2021 should rise so that people on low wages can keep more of their earnings.

Ollie also wants to see cheaper rail fares: "At the moment it's too expensive to use."

'We live on £700 a month. Benefits don't go far enough'

Leah Daniel / BBC

Leah Daniel / BBCLeah Daniel, 23, and her partner are entitled to £800 a month in Universal Credit and the council pays £900 a month rent for the flat in Birmingham they share with their two-year old daughter.

But currently around £100 a month is being deducted from their Universal Credit to pay for advances they took while homeless for a short time.

Leah says they run out of money every month and have to borrow from friends and family, sometimes having to skip meals to make sure their daughter is fed.

If the government decides to cut the welfare budget in the Spending Review, that would be "absolutely heartless", she says.

"It's one thing to make sure the country's growing and we aren't wasting money and people aren't taking advantage of the system.

"It's another thing if you aren't giving more support to help people out of poverty and help them look for work," she says.

Above all she and her partner want stable jobs so they can "build up their lives".

"So many times we haven't eaten and we're worried about tomorrow," she says. "I just want this situation to change."

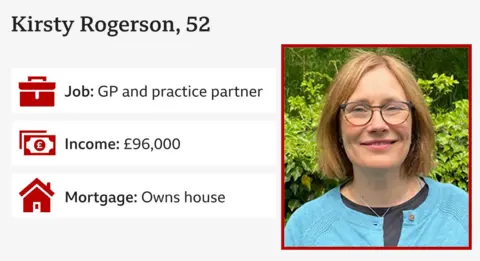

'I earn £96,000. Fruit and veg should be affordable for all'

Kirsty Rogerson/BBC

Kirsty Rogerson/BBCAs a GP and practice partner earning £96,000 a year, Dr Kirsty Rogerson says she is aware she is well-off.

She and her husband, a hospital consultant, own their own house, and are putting some money aside to support their sons through university.

But she sees plenty of people in her surgery in Sheffield who aren't so fortunate and face what she thinks are impossible choices.

If she could choose one thing for the government to take action on it would be to subsidise fresh fruit and vegetables and make processed food more expensive.

"What [the government] shouldn't be doing is just tackling it at the other end with weight loss drugs," she says. "That's going to bankrupt the NHS."

She would also like to see more money spent on public services.

"As a mother, I'd rather pay more tax and know my children were being well educated and there's a good healthcare system," says Dr Kirsty Rogerson. The same goes for the police.

"I'd rather go to bed each night knowing those things were there," she says.

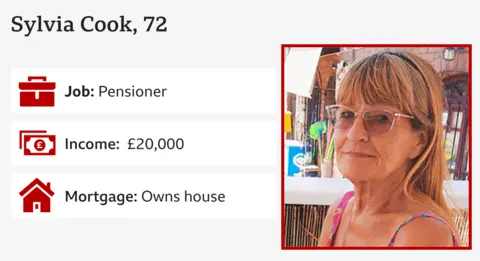

'My pension is £20,000. The government should make savings'

Sylvia Cook / BBC

Sylvia Cook / BBCSylvia Cook, 72, used to sell accounting software, then published books about Greece, before she retired.

Living on a pension of £20,000 means being careful with her outgoings, so she welcomes the government's u-turn on winter fuel payments as "a good decision, if a little late".

The extra £200 "obviously eases things", she says.

But in general she thinks that rather than increasing spending, the government should look at where it can save money.

"You can spend a lot of money and achieve nothing," she says.

Instead she suggests changes to the tax system, efficiency savings across government and cutting perks for MPs and civil servants.

"There are so many inefficient things they haven't got the common sense to sort out."

The health service is a case in point she says.

"Throwing more money at the NHS doesn't necessarily help if they don't sort that out," she says.