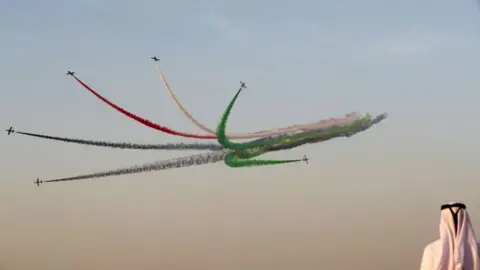

Dubai Air Show: Aerospace industry meets for deals and displays

AFP

AFPThe eyes of the world's aerospace and defence industries will be on Dubai this weekend as one of the industry's biggest air shows takes off.

While the larger Farnborough and Paris events may attract more visitors and exhibitors, Dubai has in recent years been where most of the biggest deals have been done.

Like its European rivals, the Gulf emirate's five-day show will be a battleground for commercial aircraft sales between Airbus, Boeing, and the second-tier manufacturers.

But Dubai is also a key venue for arms deals. The sensitivity of defence contracts means many are negotiated below the radar. Given the scale of Middle East defence budgets few arms manufacturers can afford not to have a presence at Dubai.

All the major names will be among the 1,300 exhibitors showing up this week, including Britain's BAE Systems, France's Dassault, and the biggest defence firm of all, America's Lockheed Martin, will all be out in force.

Regional insecurity

The latest Military Balance report from the Institute of Strategic Studies says that as a proportion of gross domestic product - the size of the economy - seven of the top 10 biggest spenders are countries in the Middle East or North Africa.

Oman is top of the rankings, committing 11% of GDP to defence spending, followed by Saudi Arabia with 10.8%. Last year the US defence budget was 3.1% of GDP, while in Europe - as President Donald Trump has often critically noted - many NATO members fail to hit the 2% target.

Greater insecurity in the region means, inevitably, that defence spending will rise, says Charles Forrester, analyst at the information and intelligence group Jane's.

Getty Images

Getty ImagesHe says: "Events over the past year, as Iran has become increasingly aggressive, have shown that there is a strong need for surveillance capabilities to ensure that critical national infrastructure remains secure, and that governments have the right information to respond."

Britain's Royal Air Force has, without the usual fanfare that often accompanies such things, decided to send out a Typhoon fighter jet, made by BAE Systems and its European partners. And the French Air Force is displaying its rival Rafale jet, spurring speculation there could be contracts in the offing for both fighters.

Dubai will, for the first time, see an appearance of America's F-35 Lighting II fighter, whose development costs are estimated to be $1.5tn (£1.2tn) over the lifetime of the decades-long programme.

Given the geo-political nature of the defence industry, the appearance of the F-35 may influence whether Russia sends its rival stealth fighter, the Sukhoi Su-57.

Boeing vs Airbus

In addition to this supersonic hardware there will be an array of surveillance and electronic warfare aircraft, missiles, drones, infrastructure and innovations - much of it of a highly classified.

For the United Arab Emirates' military, the biennial Dubai show is a chance to "discover new technology and equipment, and network with key industry players from around the world", says assistant undersecretary for defence Major General Abdulla Al Hashmi.

Getty Images

Getty ImagesThe show, though, is not just a chance to buy in equipment. Dubai and the larger emirate, Abu Dhabi, as well as Saudi Arabia, are increasingly developing their own capabilities in aerospace manufacturing, maintenance, and repair in both the civil and military spheres.

Major General Al Hashmi adds that the show is a chance "to demonstrate what the UAE is capable of".

The UAE's Tawazun Economic Programme, for example, includes ambitious plans to make the emirates a centre of 3D printing, blockchain, smart sensors and quantum computing. Last month 25 state-owned and independent companies in the UAE were consolidated under a defence company called Edge.

Mr Forrester says: "The UAE will be well-positioned as both and investor and manufacturer in the global aerospace industry."

The show is not all about defence, of course. Civil aircraft sales will make most of the headlines.

NurPhoto

NurPhotoAt the 2013 Dubai show there were $206bn worth of firm orders and options for passenger aircraft, most shared between Boeing and Airbus. In 2017 there were $114bn worth of sales.

This week's event won't scale those heights, partly because the finances of the major Middle East airlines are shakier, and partly because airlines already have so much on order that the production lines at Boeing and Airbus are committed for years ahead.

But Boeing's latest forecast for commercial jets estimates that the Middle East aircraft and services market will be worth $1.5tn over the next 20 years.

Last minute haggling

The Dubai show could be especially important for Boeing, given the sales and reputational damage of the 737 Max crashes and grounding of the aircraft. Boeing has so far this year logged more aircraft cancellations than orders.

There will be a focus on Dubai-based airline Emirates, which always likes to make a splash on its home turf.

Earlier this year Emirates cancelled orders for the Airbus A380 superjumbo, and said it would switch to A330s and A350s. The airline has also promised to buy Boeing 787 Dreamliners. However, neither the Airbus nor Boeing orders have been finalised.

It's thought that Turkish Airlines is in the market for aircraft, as is fast-growing Emirati budget carrier Air Arabia. Look out, too, for announcements from airlines in Asia, where air travel is growing apace.

Air shows are an ideal marketing venue to promote blockbuster deals if companies can agree contracts in time. Behind the closed doors of the chalets and meeting rooms set up near Dubai's Al Maktoum International Airport, executives are engaged in some intense last-minute haggling.