UK inflation falls to two-year low in January

Getty Images

Getty ImagesUK inflation fell to a two-year low in January, dragged lower by falling energy bills and fuel.

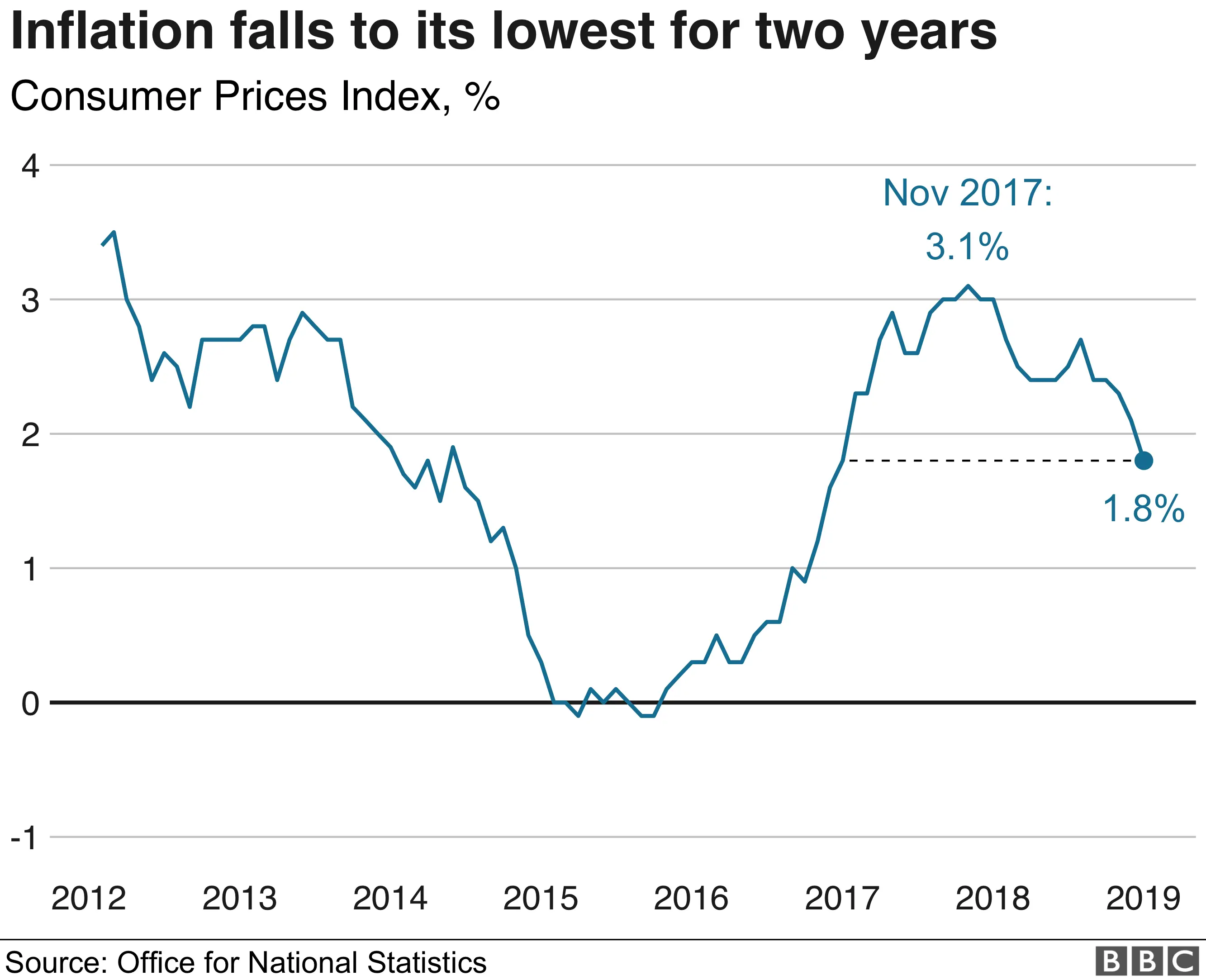

The Office for National Statistics said the Consumer Prices Index (CPI) was 1.8% last month, from 2.1% in December.

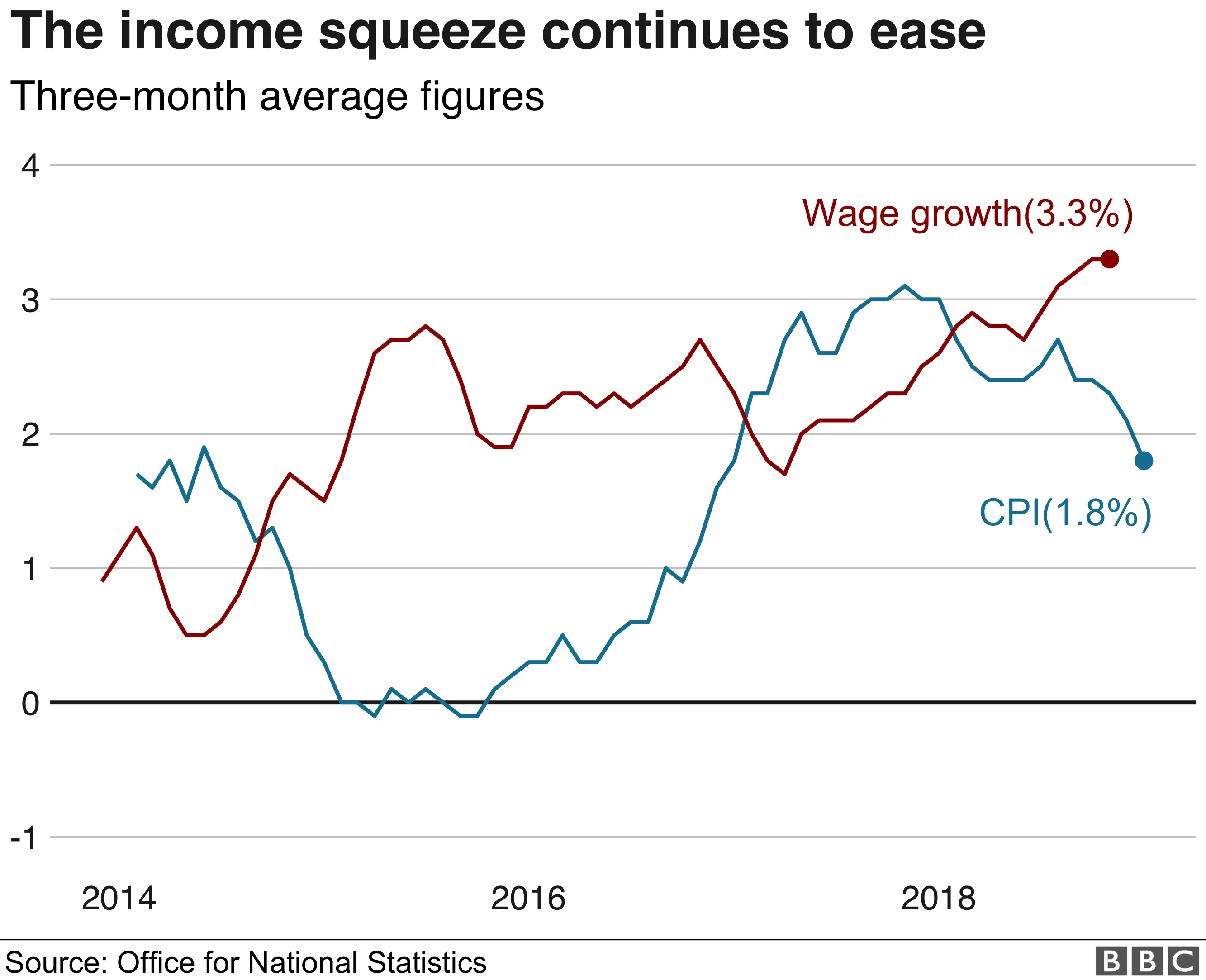

January's fall, partly offset by higher air and ferry fares, was bigger than economists' forecasts and comes as latest data shows wages rising by 3.3%.

Inflation peaked at a five-year high of 3.1% in November 2017, and was last at 1.8% was in January 2017.

Economists had forecast that CPI would fall in January to 2%, the Bank of England's inflation target.

Why is inflation falling?

Mike Hardie, ONS head of inflation, said: "The fall in inflation is due mainly to cheaper gas, electricity and petrol, partly offset by rising ferry ticket prices and air fares falling more slowly than this time last year."

Ofgem's energy price cap, which came into effect from 1 January 2019, helped drive down inflation, the ONS said. However, that cap is being raised and this is likely to feed into future CPI figures.

The ONS said that petrol prices were also down by 2.1% per litre between December 2018 and January 2019 due to falling crude oil prices.

Hotel and restaurant prices were also lower while prices of women's and children's clothing saw larger price drops than a year earlier.

What does it mean for the cost of living?

As wages are rising at 3.3%, Tej Parikh, senior economist at the Institute of Directors, said the lower inflation was a "boon" for the economy as it attempts to weather the effects of uncertainty.

"For the past two years, households have been squeezed between high prices and weak wage growth. With inflation now at a two-year low and growing upward momentum in pay packets, consumers are likely to feel less of a pinch on their wallets.

"This easing in the cost of living should provide some uplift for the High Street just as consumer confidence appears to be waning," Mr Parikh said.

Ian Stewart, chief economist at Deloitte, also highlighted the potential relief for retailers.

He said falling inflation alongside rising earnings was "delivering a powerful uplift to spending power".

"Brexit dominates at the moment but were Brexit risks to ease, consumers would be well placed to hit the High Street," he added.

Will inflation keep falling?

Some economists think it is unlikely that inflation will fall much more. For instance, Ofgem's energy price cap may not suppress inflation for long, as the cap is due to rise in April.

Andrew Wishart, UK economist at Capital Economics, said: "The fall in CPI inflation below the Bank of England's 2% target for the first time in two years in January provides a further boost to households' real spending power, but we doubt inflation will fall any further."

Much could depend on the course of the Brexit negotiations, according to Howard Archer, chief economic advisor to the EY Item Club.

"Domestic inflationary pressures are expected to pick-up only modestly over the coming months amid likely limited UK growth," said Mr Archer.

Assuming there is a Brexit deal, he said inflation could stay below 2% this year - and even dip to 1.6%.

If there is not a deal, Mr Archer said the picture would be different and the Bank of England could cut interest rates as "economic activity would likely take a significant hit".

Getty Images

Getty ImagesAnalysis: Andy Verity, economics correspondent:

We are used to hearing that our living standards have been hit by a nasty combination of above-target inflation, driven by rising energy prices, and weak pay rises. So it's refreshing to hear that has gone into reverse.

The biggest driver of lower inflation, now below the Bank of England's 2% target for the first time in two years, was energy. Gas and electricity prices fell, between December 2018 and January 2019, by 8.5% and 4.9%.

The price cap had an effect (although prices may soon rise as the cap rises). But there's also little inflationary pressure coming down the pipeline - for example, from higher raw material costs for producers.

With pay, at the last count, rising by 3.3% living standards are now rising faster than they have since November 2016.

Just because, collectively, we are now in an economic slowdown, doesn't mean we each, individually, are getting worse off.

How does it compare with wage rises?

Economists would usually expect higher wages and a lower unemployment rate - data last month showed job vacancies are at a record high of 853,000 - to push up the rate of price increases.

Ben Brettell, senior economist at Hargreaves Lansdown, said the data showed the "continued breakdown of the relationship between the labour market and inflation".

"Theory dictates that a tight labour market, low unemployment and higher wage growth, should lead to higher inflation. This means policymakers face a straight trade-off between inflation and unemployment.

"But at present the inflation genie is still firmly in the bottle, despite unemployment at multi-decade lows. This has made the Bank of England's job much easier over the past few years," Mr Brettell said.