Flybe up for sale weeks after profit warning

Getty Images

Getty ImagesFlybe has put itself up for sale, just weeks after issuing a profit warning.

The Exeter-based regional airline's board confirmed it was "in discussions with a number of strategic operators about a potential sale of the company".

Flybe said it was also reviewing other "strategic options", including cutting more flights in the face of challenges.

A spokesman for the airline said there was no threat to tickets and flights that had already been purchased as a result of the review.

Last month, the airline warned full-year losses would be £22m, blaming falling consumer demand, a weaker pound and higher fuel costs.

Latest results, published on Wednesday, show that pre-tax profits for the six months to 30 September fell by 54% to £7.4m, on revenues down by 2.4% to £419.2m.

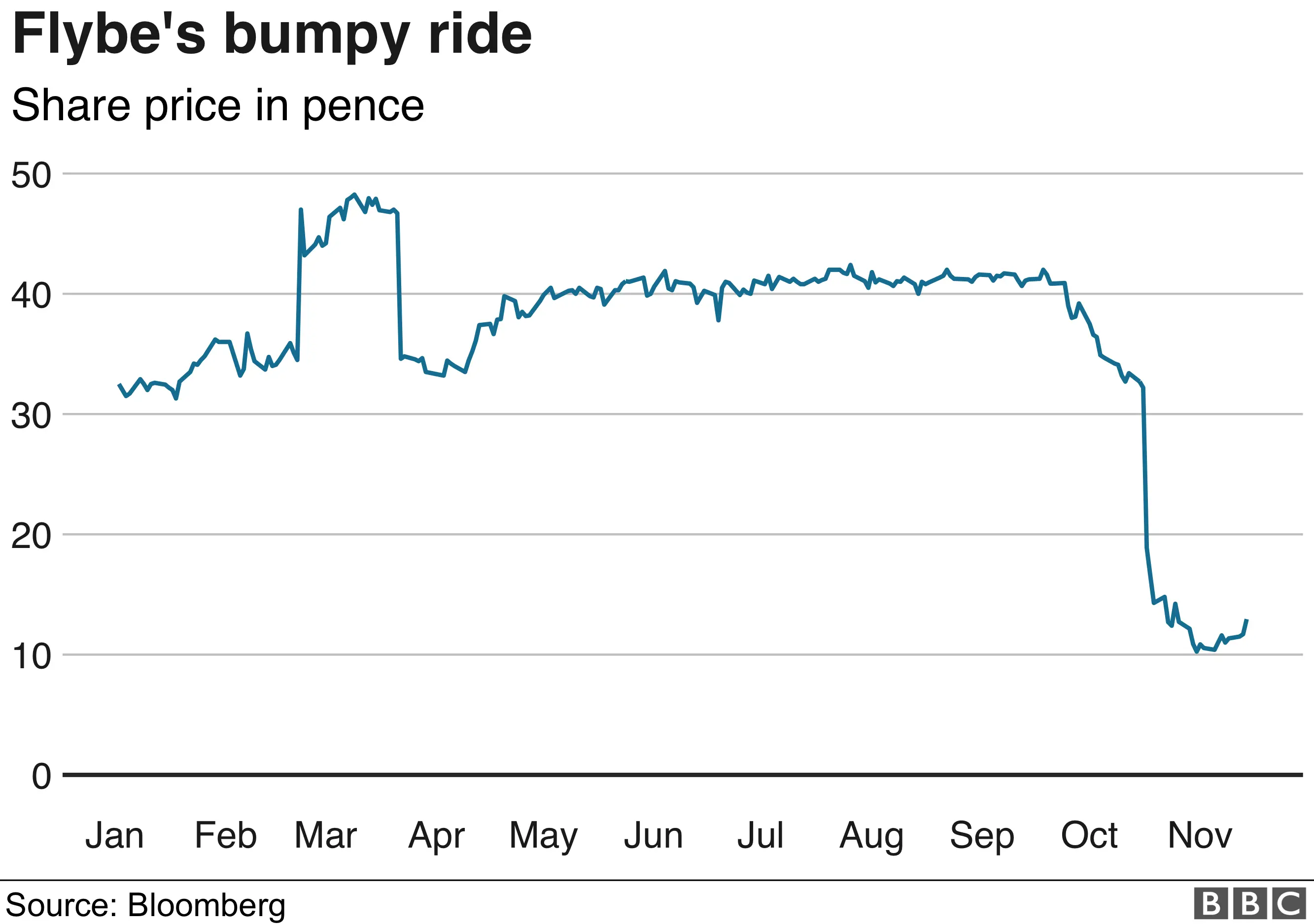

The airline's shares have fallen by almost 75% since September.

The Exeter-based airline is now valued at about £25m, far below the £215m it was valued at when it floated on the stock exchange in 2010.

However, following the announcement of the review, shares leapt by 37%.

Eoin Murray, head of investment at Hermes Investment Management, told the BBC Flybe had "suffered from weaker consumer demand, which is typical for operators of regional airports and have also blamed Brexit uncertainty and a weaker pound unsurprisingly".

He says that "the usual suspects" are in the frame as potential buyers of the regional airline.

"I saw a hint of Stobart Group, the owner of Southend Airport, as a possible rescuer. BA, historically of course, had a share [in Flybe] and sold it. So we are looking for more details."

Stobart Group and BA-owner IAG refused to comment.

In a series of tweets the British Airline Pilots' Association said Flybe's 2,300 "talented, committed" staff in the UK would be "very worried to hear... that their company is up for sale".

Balpa said it believed Flybe was "fundamentally a sound airline" and that it would scrutinise any offers for the firm to ensure jobs were protected.

It also said it expected to be consulted by Flybe and potential bidders over any future plans they had for the airline and its employees.

Allow X content?

Flybe, whose roots date back to 1979, has 78 planes operating from smaller airports such as London City, Southampton, Cardiff, Aberdeen and Norwich to destinations in the UK and Europe.

It serves about eight million passengers a year, but has been struggling to recover from a costly IT overhaul and has been trying to reduce costs.

Last month, Flybe's chief executive, Christine Ourmieres-Widener, said it was reviewing "further capacity and cost-saving measures".

"Stronger cost discipline is starting to have a positive impact across the business, but we aim to do more in the coming months, particularly against the headwinds of currency and fuel costs," she said at the time.

Getty Images

Getty ImagesAnalysis: By Dominic O'Connell, Today business presenter

Flybe says its decision to put itself up for sale is due to the "current challenges" it faces - higher fuel prices, uncertain demand and a weaker pound.

In truth, those problems are just the icing on the cake. The sale is in reality the culmination of a series of management missteps over the last decade as the company struggled to find a profitable niche.

It was squeezed from below by smaller, more nimble rivals, and from above by the likes of EasyJet and Ryanair.

Flybe has tried new aircraft - Embraer jets that eventually had to be got rid of at immense cost - and new routes - forays away from its regional base to Heathrow and London City airports - without ever finding the magic formula that would let it survive as an independent airline.

All the while, cash has flowed out the door. Today's half-year results show a net outflow of more than £30m, leaving the company with just £52.4m in cash reserves.

The accounts show that credit card acquirers, vital trade partners for airlines, are asking for more security. They also reveal departures of senior management: Vincent Hodder, head of strategy, and Peter Hauptvogel, the chief information officer, have recently left.

All these management mistakes have been funded by Flybe's long-suffering shareholders. It floated in 2010 at 295p a share and raised £150m from investors in 2014. The shares currently trade at 11p.