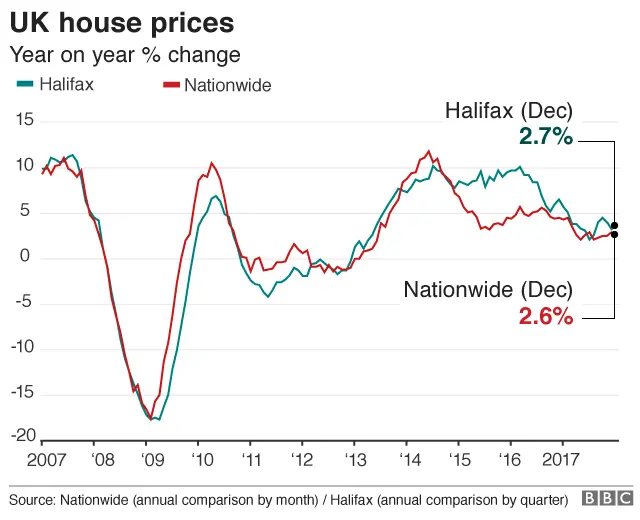

Sharp slowdown in house price growth in 2017, Halifax says

Getty Images

Getty ImagesHouse prices grew much more slowly in 2017 than in the previous year, the UK's largest mortgage lender has reported.

The Halifax said prices rose by 2.7% in 2017 - compared with a 6.5% increase in 2016. On a calendar year basis, that is the lowest rise since 2012.

The slowdown was driven by a squeeze on real wage growth and continuing uncertainty over the economy, it said.

At the end of the year the average house price across the UK was £225,021.

The Halifax research echoes last week's figures from the Nationwide, which suggested prices rose by 2.6% in 2017.

During the month of December, the Halifax said that prices actually fell by 0.6%, the first monthly decline since June last year.

However, the Halifax still expects prices to continue rising in 2018.

"Nationally house prices in 2018 are likely to be supported by the ongoing shortage of properties for sale, low levels of housebuilding, high employment and a continuation of low interest rates making mortgage servicing affordable in relative terms," said Russell Galley, the managing director of Halifax Community Bank.

"Overall we expect annual price growth to continue in the range of 0-3% at the end 2018."

Samuel Tombs, chief UK economist at Pantheon Macroeconomics, said one reason that price growth was slowing was the gradual rise in mortgage rates.

The cost of average fixed-rate mortgages has risen by between 0.1% and 0.2% since September.

"Halifax's data suggest that the recent jump in new mortgage rates has poured cold water on a market that already was flagging," he said.