Tesco takeover of Booker gets go-ahead

Getty Images

Getty ImagesTesco's £3.7bn takeover of food wholesaler Booker has been provisionally cleared by the UK's competition regulator.

The Competition and Markets Authority (CMA) said the deal could even increase competition in the wholesale market and reduce prices for shoppers.

Tesco and Booker did not compete head-to-head in most activities, it added.

Booker is the UK's largest food wholesaler, and also owns the Premier, Budgens and Londis store brands.

More than 30% of its sales are to the catering sector, which Tesco does not supply, although the supermarket is keen to get a foothold in the market.

The CMA concluded that the wholesale market would "remain competitive in the longer term", because Booker's share of the UK grocery wholesaling market, at less than 20%, "was not sufficient to justify the longer-term concerns".

Shifting trends

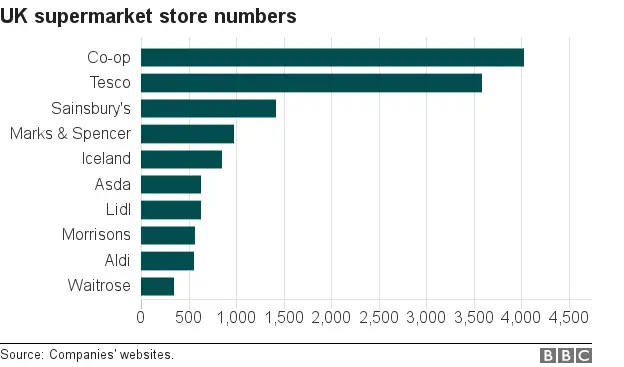

Despite losing market share in recent years, Tesco remains the UK's biggest supermarket with a share of about 28%.

The retail industry is undergoing a period of consolidation. A shift in shopping habits, fierce competition from the likes of Aldi and Lidl, and the arrival of Amazon has prompted retailers to look to bolster their businesses by buying food wholesalers.

On Monday, shareholders in the Nisa wholesaler and convenience store group approved the company's £137m takeover by the Co-operative Group.

Morrisons also recently signed a deal to become the UK wholesale supplier to convenience store chain McColls and it has also formed a tie-up with Amazon

Analysis: Emma Simpson, business correspondent

Reuters

ReutersChristmas has come early for Tesco.

The question in many minds was how many of its 1,700 convenience stores would it have to offload to get this deal through.

In other words, what would the trade off need to be to secure what Tesco sees as the bigger long term prize of a slice of the growing out of home market.

After an in depth look, including countless submissions from all part of the grocery sector, the regulator has come to the provisional conclusion that no remedies are needed.

Tesco-Booker have won the argument that their stores don't directly compete with each other.

The creation of an immensely powerful new combined food business now looks unstoppable.

Competition 'sufficiently strong'

In reaching its conclusions, the CMA found that it was "likely Booker would be able to negotiate better terms from a number of its suppliers for some of its groceries, and that it was likely to pass on some of the benefits of these savings to the shops that it supplies".

"This might increase competition in the wholesale market, as well as reducing prices for shoppers."

Simon Polito, chair of the CMA's inquiry group, said: "Our investigation has found that existing competition is sufficiently strong in both the wholesale and retail grocery sectors to ensure that the merger between Tesco and Booker will not lead to higher prices or a reduced service for supermarket and convenience shoppers."

Tesco and Booker both welcomed the CMA's provisional decision and added that they would continue to work with the competition regulator, which is due to publish its final report by the end of the year.

Booker said it was "pleased that the CMA has provisionally concluded that this transaction does not lessen competition".

Tesco said it anticipated the merger would be completed in early 2018.

However, the CMA's findings were criticised by the managing director of wholesale group Landmark, John Mills.

"This move will not increase competition, it will destroy it," he said.

"The combined Tesco/Booker operation has sales of £60bn, the rest of the UK wholesale industry amounts to £25bn. Other wholesalers will not be able to compete with the buying and distribution power of Tesco/Booker.

"So Tesco, who account for £1 in every £8 spent in the High Street will now dominate the convenience and corner shop market. And will no doubt now dominate the food service/out of home market as well."

Following the CMA announcement Tesco's shares rose by 5.7% and Booker's were up by 6.1%.