Bills push inflation to highest in more than a year

Getty Images

Getty ImagesA rise in the cost of household bills has pushed UK inflation to its highest rate in more than a year, according to official data.

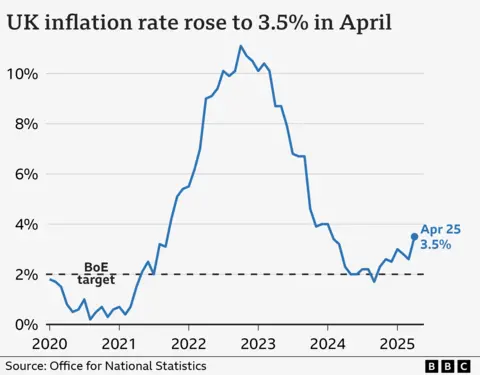

Inflation was 3.5% in April, up from 2.6% in March and higher than economists had expected.

Water, gas and electricity prices all went up on 1 April along with a host of other bills, pushing inflation further above the Bank of England's target of 2%.

Two interest rate cuts were expected this year, but some economists think April's inflation figure means it is more likely there will be only one.

Prices were expected to rise at 3.3% in the year to April.

The Bank of England has previously said it expects inflation to peak at 3.7% between July and September 2025 before slowly falling.

One of the Bank's key tasks is to keep inflation at 2% and it cuts or raises interest rates to achieve that.

The idea is that if you make borrowing more expensive, people have less money to spend. People may also be encouraged to save more.

In turn, this reduces demand for goods and slows price rises.

Huw Pill, chief economist at the Bank of England who sits on the nine-person committee which votes on interest rates, said earlier this week that he feared the Bank was reducing rates too rapidly and that the momentum behind falling inflation was "stuttering".

In April, as well as a rise in household bills firms were also hit by higher costs - a rise in employer National Insurance contributions and a higher minimum wage.

Water and sewerage prices rose by 26.1% in April, which the ONS said was the largest rise for 37 years since official records began.

A sharp jump in the cost of airfares compared to April last year also helped rive up inflation.

The later Easter this year is thought to have contributed to the rise in flight costs and package holidays, which is expected to be a one off.

Meanwhile, the cost of services specifically rose 5.4% in the year to April, which some economists attributed to the rise in National Insurance contributions for employers and a higher minimum wage coming into force.

Services inflation refers to rises in prices for services like eating at a restaurant, getting a haircut, or going to the cinema.

Britain is a services-led economy which means that more of our jobs come from providing a service rather than making a product.

Core inflation which strips out volatile prices such as energy and food – and services inflation - also rose more than expected.

Chancellor Rachel Reeves said she was "disappointed" with the figures and cited April's minimum wage rises and the decision to freeze fuel duty as helping pepole with the cost of living pressure.

Mel Stride, shadow chancellor, said the figure "is worrying for families".

"We left Labour with inflation bang on target, but Labour's economic mismanagement is pushing up the cost of living for families," he added.

'Supermarket shop is getting more and more expensive'

Tracy McGuigan-Haigh, 47, lives with her 11-year-old daughter Ruby in Dewsbury and works in retail.

She has to fit her working hours around looking after Ruby and receives universal credit on top of her wage. She says her monthly income isn't stretching far enough.

"Even on a budget, the supermarket shop is getting more and more expensive. I'm not coming out with a lot in my arms.

"Before, I'd have needed a trolley for £40 worth of food. Now it doesn't even fill a basket - you can carry that much in your arms."

She says the cost of everyday items is "killing" her and doesn't believe any future fall in interest rates will make a difference.

"It's gone too far. I've juggled so much that I've dropped balls, and somebody's going 'it'll get better'. But, even if it does improve now, what's the support for the people who are down there, who are on the floor?"