Rogue landlord 'motivated by greed' jailed

BBC

BBCA landlord who was among a group of property agents who defrauded and misled flat-hunters on an "unprecedented" scale has been jailed for three years and five months.

Mohammed Haque, along with three others, was convicted in October of eight counts of fraudulent trading. A fifth defendant was found guilty of two lesser offences.

A trading standards investigation found they posted about 18,000 misleading adverts for rooms in east London, hooking in victims who were pressured into paying deposits to move into "horrible" properties. Some ended up trapped in them while others were evicted without notice.

Many victims said their experiences had had a severe financial and psychological impact.

Haque, 47, set up various companies operating across Tower Hamlets, including Citiside Properties Ltd and Flintons, based at the same address in Mile End, and had links with several other firms, trading standards found.

Haque, his former wife Fatima Begum, 42, Gonzalo Egea, 43, and Razaur Oli, 51, were convicted at Southwark Crown Court of fraudulent trading, while Haque, Nozir Ahmed, 56, and the two companies Barrons London Ltd and Roomshare Ltd were found guilty of the less serious charge of engaging in unfair commercial practice.

Ahmed and Roomshare were also convicted of engaging in aggressive commercial practice.

'Tip of the iceberg'

One man told Southwark Crown Court his life was made "hell" by Flintons and he was left feeling suicidal by the firm, while another tenant said he was treated like a "stray dog".

One victim said she was forced to live in a flat ridden with mice; others said they felt "violated" and were left penniless.

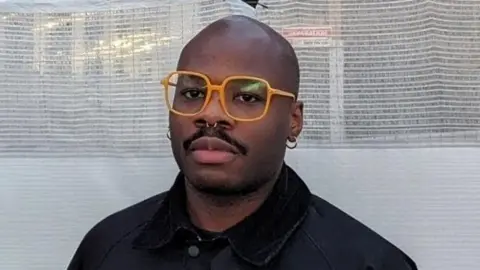

Israel Kujore

Israel KujoreTower Hamlets trading standards investigation team leader Sean Rovai said the case was "virtually unprecedented in its size and complexity", with more than 200 known victims between 2017 and 2021.

However, he said that number was likely to be the "tip of the iceberg".

The defendants appeared to target those unfamiliar with the London rental market, such as foreign workers and students, using popular sites such SpareRoom to post misleading pictures of rooms that were not in fact available, the investigation found.

Prospective tenants were tricked into parting with large deposits, pressured into taking out tenancies without being able to view properties first, and many became "stuck" in low-quality accommodation that bore no resemblance to adverts.

Some were threatened when they tried to move out while others found themselves trapped, without anywhere else to go, investigators found.

When tenants chose to leave at the at the end of their contracts, their deposits were not returned to them.

Tower Hamlets Council

Tower Hamlets Council"Almost every area of malpractice in this industry that we see was encapsulated in this one case," Mr Rovai said.

"It was all motivated by greed and profit. And there was very little sympathy for any of these victims."

In some cases, the firms evicted tenants with no notice by removing all their possessions and changing the locks while they were out.

Tenants were treated "terribly", Mr Rovai said.

'I had nowhere to go'

Fashion worker Julius Agyei, who rented a room from Flintons, said he was "devastated" by what happened to him after he moved to London from Manchester.

Arriving home to Mile End from a day out at Winter Wonderland in December 2018, he found his key did not work.

"Everything was locked," he said.

When a housemate let him in, Julius found all his possessions had been removed from his room.

"It was empty, there was literally nothing; I was devastated. All my clothes, shoes, my passport, lots of meaningful items... I never got them back."

Julius spent the night on the street before seeking help at a homeless hostel the following day.

"I had nowhere to go... I had nothing so I literally had to start from scratch... it took me a while, it was very challenging."

Julius said in the years that followed, he suffered panic attacks, a breakdown and flashbacks.

"I was traumatised by it... it wasn't just shoes and clothes, it was deeper than that."

Usually, landlords must obtain a court order to evict tenants.

But these companies tricked people into signing what are known as licence-to-occupy agreements - usually used for holiday accommodation - which effectively enabled them to throw people out on the street.

The firms were "not averse" to getting rid of those who complained, Mr Rovai said.

"There was always a queue of people desperate for housing so they can afford to kick them out."

Many victims took out tenancies after being lured in with "bait-and-switch" advertising.

The firms used photos of high-quality accommodation that was not actually available, in order to generate interest.

Yan Liu

Yan LiuYan Liu was hooked in by one such advert on SpareRoom for a room in a property near the Bow Road in Mile End, when she was studying medicine nearby.

"It was pristine and £600 per month."

She went to the Citiside Properties office an hour later but was told the room was no longer available.

"I was about to leave but they insisted to show me other properties."

She was then pressured into paying £300 just to view an alternative room. However, the firm did not show her the room and refused to refund her money.

She was told the only way to get her money back was to redeem it indirectly by taking out a tenancy agreement.

"£300 is is not a small amount of money," Yan said. "I felt that because I paid that deposit with them, I didn't have any other choice: if I want to get the money back, I have to rent with them."

The room Yan eventually moved into was more expensive and "much crappier" than the one she saw advertised, she said. It had no heating and a faulty electricity supply, meaning she could not cook.

'Humiliated and embarrassed'

Israel Kujore went to the Flintons office after enquiring about a flat he and his friend had seen advertised on SpareRoom.

"It was so quick – you went through the door, sat down... felt like you were barely given a chance to consider things."

The agents implied that if they didn't immediately pay deposits, they would lose the chance to rent the flat, Israel said.

So they signed up "out of desperation".

"We paid £300 each on the spot... and when we walked out we thought: 'What just happened there?' We felt so humiliated and embarrassed... it took just five or 10 minutes for them to take £300 from us.

"We were both quite young and I think they were taking advantage of that. It put me in a bad way, I didn't have money... or the bank of mum and dad."

Investigators discovered that many renters became "stuck in horrible conditions" because they had nowhere else to go.

"People would literally turn up with their suitcase," Mr Rovai said.

"They'd maybe just arrived in the country or left their accommodation elsewhere and they come expecting to move into this property that had been sold to them online.

"Then they're told that property had gone... that's how the pressure's put on these people."

Once they had signed a contract, many of them were "stuck", he said.

"If they walked away from the contracts, not only have they lost all the money that they've already paid up, but they've been threatened by the company."

The business model the firms operated on was largely a "rent-to-rent" arrangement, whereby the companies would obtain flats and houses from owners and assure them of a guaranteed rental income each month, trading standards said.

The firms were found to have more than 200 east London properties on their books, and would often subdivide them - sometimes without planning permission - to make more rooms available to rent.

They would rarely have the appropriate licences for renting them out, and the properties would generally be in a poor state of repair.

Trading standards told the BBC that while a case on this scale was unusual, this type of activity was becoming more common, as London's housing crisis deepened.

"A decade ago, this was not a sector that was on our radar... now it's become our most complained-about sector," Mr Rovai said.

"This is far more prevalent than any other sort of consumer protection issue that we see, certainly in London."

The criminal investigation into the defendants' firms began in 2019 after a large number of complaints were made to trading standards, Citizens Advice and Action Fraud.

This was a case so prolific it could not be ignored, Mr Rovai said.

"These are all common areas of malpractice within that industry and we wanted to not just to make an example of them, but to say these type of practices are illegal and we will make a stand against that... it's something we're very passionate about."

'Advertisers banned from platform'

On Tuesday at Southwark Crown Court, Begum was given a four-month suspended jail sentence, Egea a two-year suspended sentence with 180 hours of unpaid work, while Oli received a 12-month suspended sentence with a nine-month curfew.

Ahmed was given a four-month suspended jail sentence with 150 hours of unpaid work.

Sentencing the defendants, Judge Tony Baumgartner praised their victims for their resilience.

Lutfur Rahman, mayor of Tower Hamlets, said: "If you exploit our residents or jeopardise their safety, the council will do whatever it takes to bring your case to justice.

"I want to express my heartfelt gratitude to the complainants who shared their experiences in court, shedding light on how these unlawful and misleading practices have affected their lives.

"This case underscores the critical need for rigorous enforcement of regulations."

SpareRoom told the BBC that it puts "a huge amount of resource" into combating fraud and protecting users of the site from rogue landlords.

"We banned these advertisers from our platform for breaking our terms and conditions," the company's Matt Hutchinson said.

He also said advances in technology and new regulations had made it easier for the site to detect bait-and-switch adverts and unregistered letting agents.

Listen to the best of BBC Radio London on Sounds and follow BBC London on Facebook, X and Instagram. Send your story ideas to [email protected]