Trump tariffs spark US government debt sell-off

Getty Images

Getty ImagesConfidence in the US economy is plummeting as investors dumped government debt amid growing concerns over the impact of Donald Trump's tariffs.

Governments sell bonds - essentially an IOU - to raise money from financial markets for public spending and in return they pay interest.

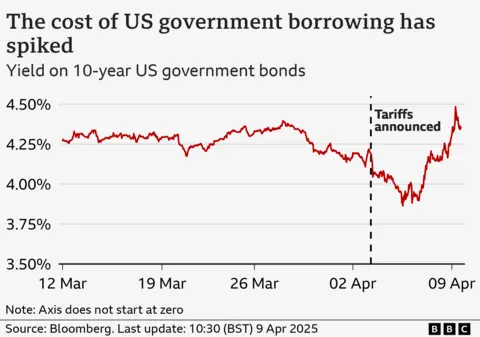

The US does not normally see high interest rates on its debt as its bonds are viewed as a safe investment, but on Wednesday rates spiked sharply to touch 4.5%.

The rise came after Trump pressed ahead with sweeping tariffs on goods being imported into the US, while Washington's trade war with China escalated further - although Trump on Wednesday did put a 90-day pause on higher tariffs for some countries.

After the US implemented a 104% tariff on products from China at midnight on Wednesday, Beijing hit back with 84% levy on American products. Trump later raised the tariff on China to 125%.

Stock markets have been falling sharply over the past few days in reaction to the escalating global trade war and fears of tariffs leading to higher prices, although US stocks soared when Trump announced the 90-day pause and a lowered 10% reciprocal tariff for other countries.

However, the sale of bonds in the US poses a major problem for the world's biggest economy.

The interest rate - or yield - for US government borrowing over 10 years has spiked sharply in the past couple of days from 3.9% to 4.5%, the highest level since February.

The rise has spooked economists because US bonds are traditionally seen as a so-called safe haven for investors to put their money in times of financial turmoil.

"Rising bond yields mean higher costs for companies to borrow, and of course governments too," said Laith Khalaf, head of investment analysis at AJ Bell.

"Bonds should do well in times of turmoil as investors flee to safety, but Trump's trade war is now undermining the US debt market," he added.

While interest rates on US government debt rose, the price of the bonds themselves fell as demand weakened due to investors offloading them.

Mohammed El Erian, chief economic advisor at Allianz and former boss of the biggest bond manager Pimco, said one reason US borrowing costs had shot up was because there had been an "erosion" of bonds being seen as a safe haven.

He added concerns over the impact of tariffs on inflation and US government budgets were also reasons.

Will the Federal Reserve step in?

Some analysts suggested that America's central bank - the US Federal Reserve - might be forced to step in if turbulence continues, in a move reminiscent of the Bank of England's emergency action in 2022 following Liz Truss's mini-Budget.

"We see no other option for the Fed but to step in with emergency purchases of US Treasuries to stabilise the bond market," said George Saravelos, global head of FX research at Deutsche Bank.

"We are entering uncharted territory," he said, adding that it was "very hard" to predict how markets would react in the coming days as the bond market suggested investors had "lost faith in US assets".

Mr El Erian told the BBC's World At One that the Fed would be "torn" over what action to take, given its main mandates are to manage inflation and maximise employment.

Economists have predicted US tariffs, which will be paid for by American companies importing goods from abroad, will raise consumer prices domestically.

Trump's plan is aimed at protecting American businesses from foreign competition and also to boost domestic manufacturing.

However, tumbling stock markets resulting from fears extra taxes will hit the profits of companies, could lead ultimately to firms cutting jobs and an economic downturn.

'US recession a coin toss'

JP Morgan, the investment banking giant, has raised the likelihood of a US recession from 40% to 60% and warned that American policy was "tilting away from growth".

Simon French, chief economist at Panmure Liberum, told the BBC that the Fed could decide to cut interest rates in a bid to protect US jobs by making it easier for businesses to borrow cash as they face higher costs from tariffs.

He said it was a "coin toss" over whether the US would enter a recession.

This is defined as a prolonged and widespread decline in economic activity typically characterised by a jump in unemployment and fall in incomes.

'US sneezes, UK catches a cold'

Mr El Erian said the UK was likely to be impacted by the US bonds sell-off.

"When US treasuries sneeze, UK government bonds catch a cold - we have seen a significant move up in UK bond yields which means more pressure on the Budget," he added.

Rising UK bond yields means "higher borrowing costs for companies and households," he added.

The Bank of England warned on Wednesday that US tariffs "contributed to a material increase in the risk to global growth" and financial stability.

"Uncertainty has intensified," it said.

Investors are now betting on the Bank to cut interest rates by as many as four times, to bolster the economy against a potential economic downturn.

US Treasury Secretary Scott Bessent claimed that Trump's goal was to bring "jobs and manufacturing back to the United States, raising wages, increasing revenues and reviving the American Dream".

He said the Trump administration was looking to "right the wrongs of longstanding global trade imbalances".

Questions remain over the scale and what type of investors are dumping US bonds.

There has been speculation some foreign countries, such as China which owns some $759bn of US bonds, might be selling them.

Mr Saravelos warned there could be "no winner" to this trade war. "The loser will be the global economy," he added.

Follow the twists and turns of Trump's second term with North America correspondent Anthony Zurcher's weekly US Politics Unspun newsletter. Readers in the UK can sign up here. Those outside the UK can sign up here.