Fact-checking three key claims about Trump's mega-bill

BBC

BBCPresident Donald Trump's flagship piece of legislation - which he's labelled the "big beautiful bill" - has faced major objections from Democrats as well as from some Republicans.

It has been subject to tense negotiations amid questions about how much it could cost and its proposed cuts to some US welfare schemes.

Elon Musk has also weighed in, repeating threats to form a new political party if the "insane spending bill passes".

BBC Verify has looked at claims made about the bill's possible impact in three key areas - the US national finances, medical cover, and taxes.

How much would the bill cost?

The White House has said the bill "reduces deficits by over $2 trillion" - but senior Democrats have insisted it would actually add trillions.

BBC Verify has examined various independent studies about the bill's impact and interviewed six tax experts who all agreed that it would increase the national deficit.

The deficit is what happens when the US government spends more than it collects through taxes and other forms of revenue.

Musk criticised lawmakers who "voted for the biggest debt increase in history" when it was being passed in the US Senate.

The debt is the overall sum of money owed by the government - essentially the accumulation of past budget deficits - which means it has to borrow money and pay interest on this.

- Live updates as Trump's mega-bill heads for final vote

- A look at the key items in Trump's sprawling budget bill

- 'Our food doesn't even last the month' - Americans brace for Trump's welfare cuts

The US national debt is currently about $36tn (£26tn) - of which about $29tn is money owed by the government to investors around the world.

Larger deficits and a bigger debt can theoretically result in higher interest rates - the idea being that investors worry more about a country's capacity to pay its debts as those rise and they therefore demand higher interest payments.

That can feed into higher interest rates for consumers which make things like housing and cars less affordable, and restrict business investment and therefore productivity and jobs.

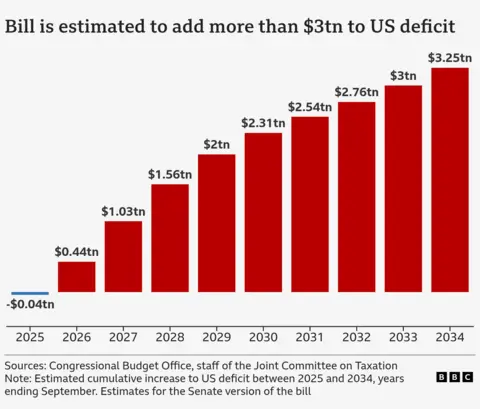

The current version of the bill is estimated to add about $3.3tn (£2.4tn) to the US deficit over the next 10 years, despite an initial economic boost, according to estimates from the Congressional Budget Office (CBO) - the government agency which provides independent analysis of spending.

The CBO said the spending cuts proposed in the bill would be outweighed by the tax cuts.

An analysis from the Tax Foundation think tank concluded that the bill "would increase economic output but worsen deficits". It projects that the bill would increase the level of US GDP by around 1% after 10 years relative to where it would otherwise be, but that it would also add $3.6tn (£2.6tn) to the deficit over the same period.

Some banks have said they are in favour of the bill - with the American Bankers Association writing an open letter to lawmakers saying it provides "much needed tax relief" which would boost the economy.

The experts BBC Verify spoke to said although the bill may provide some economic growth, its cost would be significantly more than this boost.

"Most analysis finds that the bill will produce a small, temporary, short-lived boost – but that over time the bill will actually be a drag on the economy," says Bobby Kogan, a federal budget expert at the Center for American Progress, a left-leaning policy institute.

And Mark Zandi, an economist at the financial consultancy Moody's Analytics, says: "It will result in continued massive budget deficits, and a high and rising debt load."

What impact would the bill have on Medicaid?

"We're cutting $1.7 trillion in this bill and you're not gonna feel any of it. Your Medicaid is left alone. It's left the same," Trump claimed at an event about the bill last week.

However, various studies show there will be significant reductions to Medicaid under the bill.

Medicaid is the government-run scheme which provides healthcare insurance for about 71 million low-income adults, children, pregnant women, elderly adults and people with disabilities.

Analysis by the Kaiser Family Foundation (KFF) - an independent health policy research group - found that the bill would cut $1tn (£729bn) from future Medicaid spending over the next 10 years.

The White House has said the bill "removes illegal aliens, enforces work requirements, and protects Medicaid for the truly vulnerable".

The CBO estimates that nearly 12 million Americans would lose health insurance by 2034 under the terms of the Senate bill - with just 1.4 million of these being people "without verified citizenship, nationality, or satisfactory immigration status".

What about the impact on taxes?

Trump has repeatedly said that not passing the bill would lead to massive tax rises on Americans - in part because the tax cuts passed during his first-term in office are due to expire at the end of this year.

"If it's not approved, your taxes will go up by 68%," the president said last week.

We asked the White House for the calculations behind Trump's claim - they responded saying the bill "prevents the largest tax hike in history" but didn't answer our question on where the specific figure comes from.

Getty Images

Getty ImagesThe Tax Policy Center estimates that not extending tax cuts introduced under Trump in 2017 would lead to a hike of 7.5% on average.

The body also says roughly 60% of tax payers would have to contribute more if they expire.

"The 68% figure is incorrect… It could be roughly drawn from a count of taxpayers that would see an increase in taxes, as opposed to an estimate of the actual tax increase," says Elena Patel, a tax policy expert and assistant professor at the University of Utah's business school.

Overall, the tax changes in the bill would benefit wealthier Americans more than those on lower incomes, according to the Tax Policy Center analysis. About 60% of the benefits would go to those making above $217,000 (£158,000), it found.

"There is no question that this bill will result in a massive redistribution from the poorest to the richest," says Ms Patel.

Clarification - this article was updated to more accurately describe the Center for American Progress